Jan 5, 2024Investing What Is a 401 (k) Plan? Advertiser disclosure What Is a 401 (k) Plan? A 401 (k) is a retirement investment plan employers offer. The plans come with tax benefits, and

What is a 401(k) Plan?. A 401(k) is an account that allows… | by The CFMA | Medium

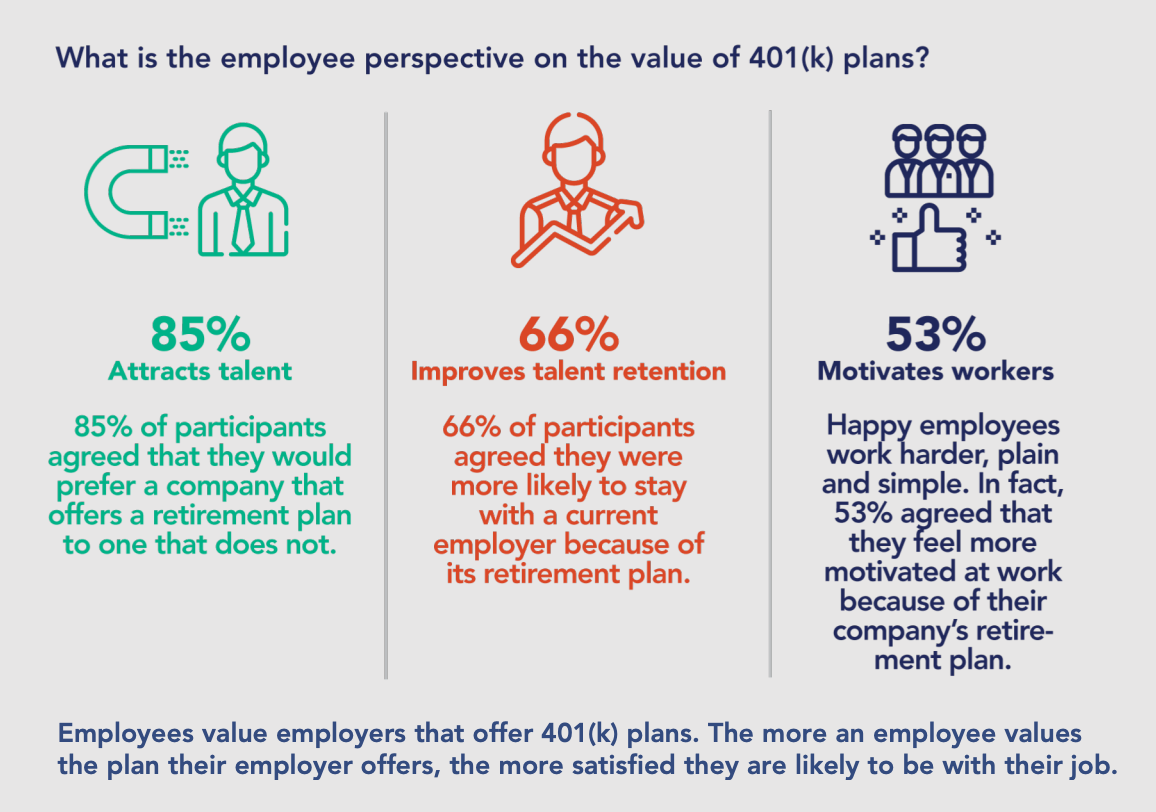

401 (k) plans are one of the most popular and successful retirement saving tools. They offer several benefits: Tax planning. A traditional 401 (k) plan reduces an employee’s immediate taxable income because contributions are tax-deferred. Many participants anticipate being in a lower tax bracket in retirement compared to their peak earning

Source Image: chase.com

Download Image

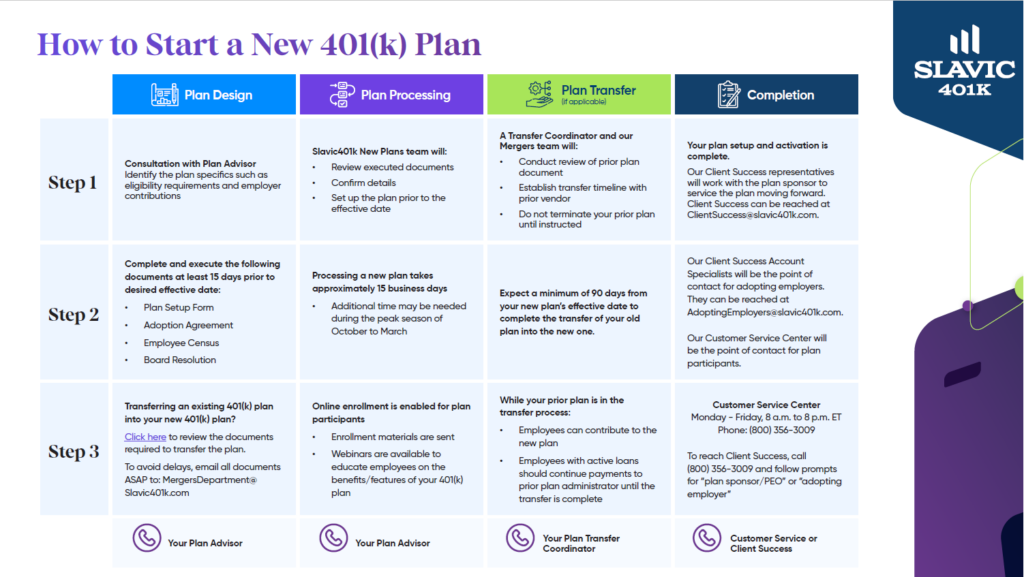

Aug 30, 2022Designing the right 401 (k) plan for your business means matching the features and options of the plan to the goals you want your employees to achieve. Generally, businesses sponsor retirement plans to: Help employees prepare for a financially secure retirement Maximize owner contributions to retirement accounts

:max_bytes(150000):strip_icc()/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Source Image: investopedia.com

Download Image

Intel gives details on future AI chips as it shifts strategy | Reuters

Let’s clarify the roles of the key players in administrating a 401 (k) or similar employer-sponsored plan: First, the plan sponsor names an officer or employee of the company as the named

Source Image: slavic401k.com

Download Image

What Does A 401 K Plan Generally Provide Its Participants

Let’s clarify the roles of the key players in administrating a 401 (k) or similar employer-sponsored plan: First, the plan sponsor names an officer or employee of the company as the named

Aug 29, 2023A 401 (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee’s wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

New 401(k) Plan Implementation – Slavic401k

Dec 11, 2023Key Takeaways A 401 (k) plan is a company-sponsored retirement account to which employees can contribute income, while employers may match contributions. There are two basic types of 401

Women’s Tennis Gets $150 Million Investment From CVC Capital – Bloomberg

Source Image: bloomberg.com

Download Image

401(k) Plan Administrator Fiduciary Responsibility

Dec 11, 2023Key Takeaways A 401 (k) plan is a company-sponsored retirement account to which employees can contribute income, while employers may match contributions. There are two basic types of 401

_Plan_Administration__(2).png?width=643&height=541&name=401(k)_Plan_Administration__(2).png)

Source Image: carboncollective.co

Download Image

What is a 401(k) Plan?. A 401(k) is an account that allows… | by The CFMA | Medium

Jan 5, 2024Investing What Is a 401 (k) Plan? Advertiser disclosure What Is a 401 (k) Plan? A 401 (k) is a retirement investment plan employers offer. The plans come with tax benefits, and

Source Image: collegiatefma.medium.com

Download Image

Intel gives details on future AI chips as it shifts strategy | Reuters

Aug 30, 2022Designing the right 401 (k) plan for your business means matching the features and options of the plan to the goals you want your employees to achieve. Generally, businesses sponsor retirement plans to: Help employees prepare for a financially secure retirement Maximize owner contributions to retirement accounts

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PPXLEXP5HZOWROYGBYQJVRH5ME.jpg)

Source Image: reuters.com

Download Image

Top AI Companies Join Government Effort to Set Safety Standards – Bloomberg

Jan 24, 2024A 401 (k) is a tax-deferred investment account, sponsored by an employer. Some plans may allow for Roth (post-tax) deferrals to allow tax-free withdrawals in the future, subject to certain requirements. There are two primary advantages to having a 401 (k)–receiving an employer contribution (if offered, which is “free money” for retirement

Source Image: bloomberg.com

Download Image

Gas Buyers in Brazil and India Are Favoring Long-Term Supply Contracts – Bloomberg

Let’s clarify the roles of the key players in administrating a 401 (k) or similar employer-sponsored plan: First, the plan sponsor names an officer or employee of the company as the named

Source Image: bloomberg.com

Download Image

202 Awesome ChatGPT Prompts to Boost Productivity

Aug 29, 2023A 401 (k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee’s wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

Source Image: blog.hootsuite.com

Download Image

401(k) Plan Administrator Fiduciary Responsibility

202 Awesome ChatGPT Prompts to Boost Productivity

401 (k) plans are one of the most popular and successful retirement saving tools. They offer several benefits: Tax planning. A traditional 401 (k) plan reduces an employee’s immediate taxable income because contributions are tax-deferred. Many participants anticipate being in a lower tax bracket in retirement compared to their peak earning

Intel gives details on future AI chips as it shifts strategy | Reuters Gas Buyers in Brazil and India Are Favoring Long-Term Supply Contracts – Bloomberg

Jan 24, 2024A 401 (k) is a tax-deferred investment account, sponsored by an employer. Some plans may allow for Roth (post-tax) deferrals to allow tax-free withdrawals in the future, subject to certain requirements. There are two primary advantages to having a 401 (k)–receiving an employer contribution (if offered, which is “free money” for retirement